OK let it rip at me. You’ve seen the title. You all hate it. The UK’s in the shitter, Starmer is a wet wipe and Reeves doesn’t know what she’s doing. Debt is up and the economy is down.

Let’s pull things up to a long long time ago. All the way back to 8th Jan. Gilts were selling off sharply starting a run which led to 10 years peaking at 4.9%, the highest level since the GFC and coming amid a cutting cycle which is some achievement. The front pages were full of the UK is entering “fiscal crisis” and Reeves is out the front door.

Readers of this blog knew otherwise. They knew that the majority of the sell off was down to shifts in yields in the US, besides a repricing for BoE expectations and higher UK inflation expectations, with less than 5bps of the rise in yields down to unexplained term premia - here lie your bond vigilantes.

We came out bullish gilts on January 10 and what do you know, as of January 17, gilts have rallied sharply with 10 year yields back to 4.63%, down some 27bps off the highs, with US equivalents down 20bps leaving some 7bps unexplained.

And what drove this major repricing? Did Labour come out and shift fiscal policy? Was Reeves fired? Did the UK make a deal with the IMF?

No, a few minor surprises on the economic data front drove a huge shift in expectations - there was no fiscal crisis to begin with. The initial move was just markets pricing an overly hawkish BoE, global shifts in yields, and likely some big institutional sales at the long end of the curve.

We’re now in the midst of a three day rally for gilts, with a huge shift in BoE expectations. Futures show markets have priced an extra cut in 2025 over the last three days, with end-2025 rate expectations at 4.1% compared to a current Bank Rate of 4.75%.

(disclaimer before we get going: As of this week, I’m long gilts, UK equities, and in and out of long sterling).

For me, this isn’t over. This gilt rally has legs. We got a speech from the BoE’s Taylor on Wednesday. He noted that 50bps of cuts in 2025 was his expectation should the BoE’s worst case of their three core scenarios play out (case 3 – structural shifts) - here’s my brief on this. This implies that market pricing is likely far too hawkish on the BoE still.

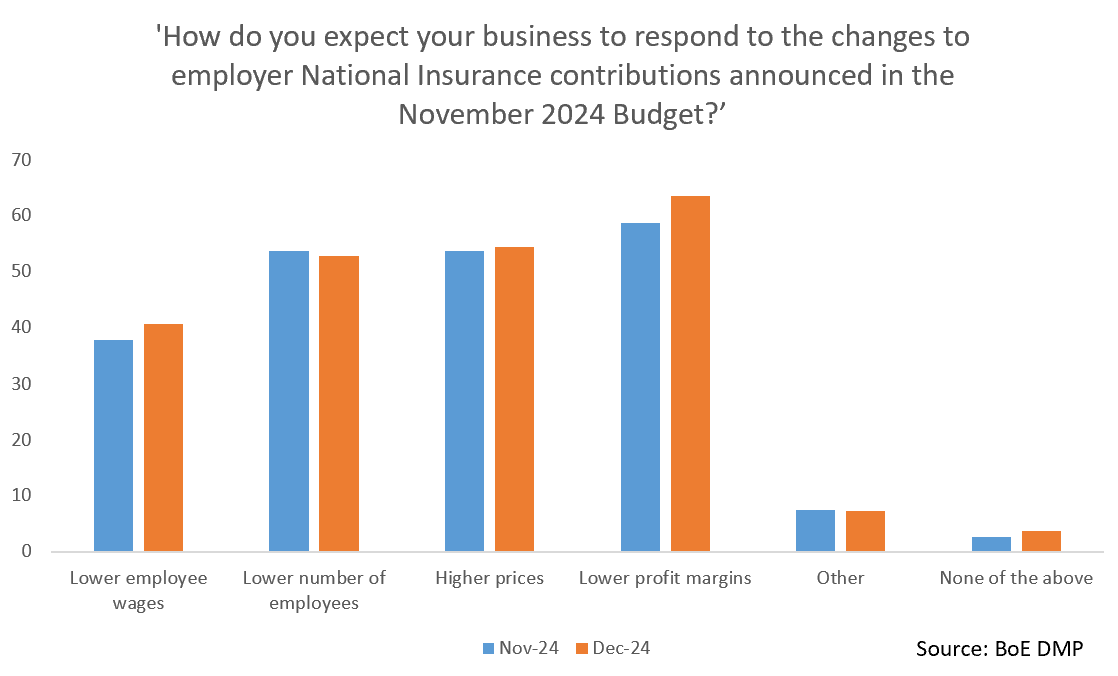

Growth is coming in poor, embedded inflation is falling (per services CPI), and wage growth is cooling. There’s some uncertainty with the National Insurance and National Living Wage changes, which is causing the Bank to be cautious, but given these look set to be absorbed to a decent extent via lower wages and margins, once the outlook on these is clear it should pave space for the Bank to be more dovish.

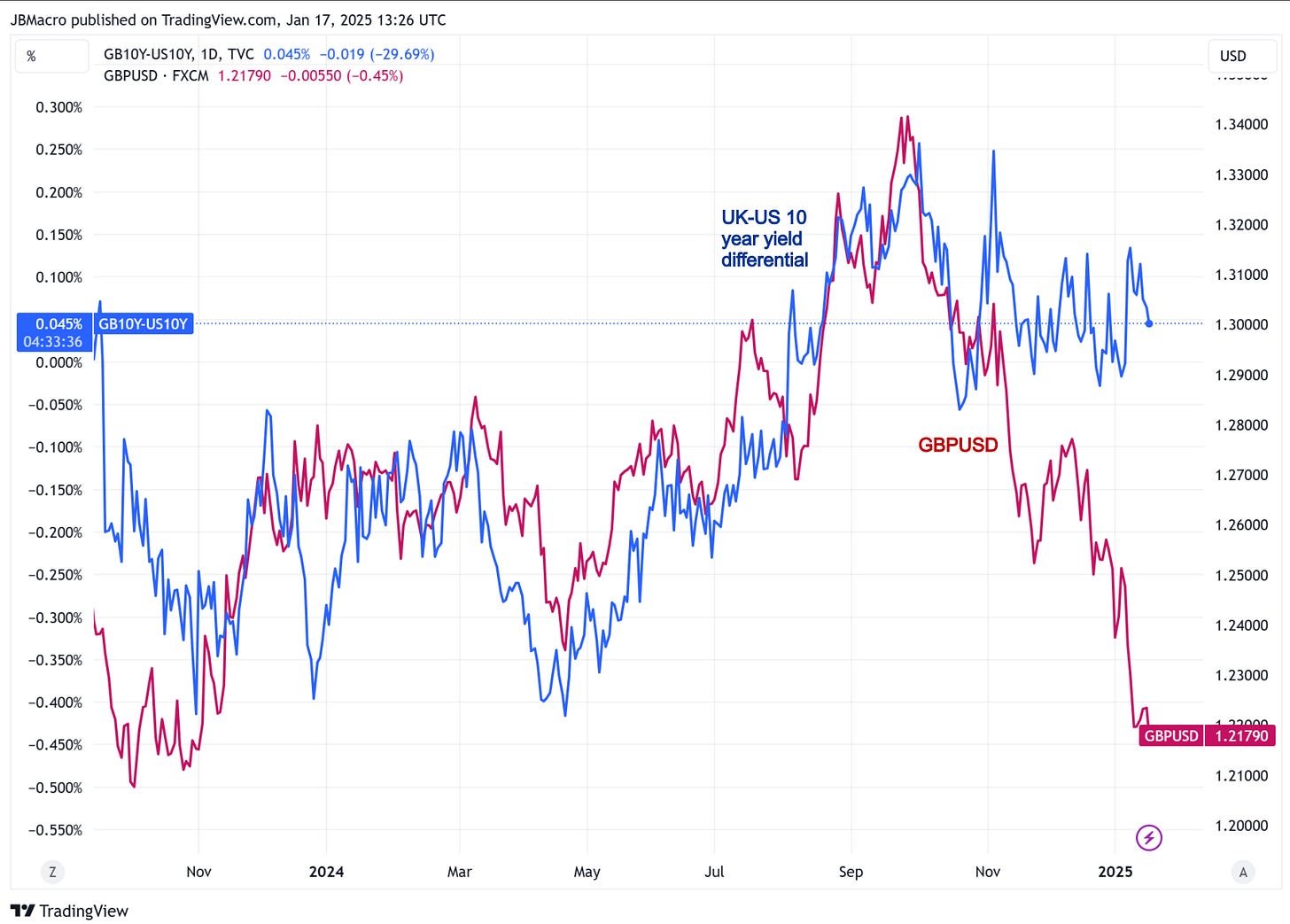

So here we are, bullish gilts, and at the same time bullish sterling. Even as UK yields fall, I reckon sterling outperforms. Since November’s Autumn Budget, sterling has been trading out of whack with yield differentials as there has clearly been some pricing for heavier gilt issuance/bond vigilante-ism.

However, this divergence really appears to have gone too far. Per yield differentials, cable should be up around 1.30, as opposed to 1.22 at the time of writing (see chart below). Over the coming months, I expect robust economic data and some positive news on the policy front (e.g. Labour’s industrial strategy, more details on national wealth fund investments, cutting red tape) to drive a more optimistic outlook.

The biggest dampener looking ahead is going to be the Spring Budget in late March, with fears that Reeves will shift the fiscal rules to facilitate more borrowing. This is the key risk to the outlook, but to me looks unlikely. Labour introduced the big policy shift back in November, and I really expect the coming budget to be a bit of a non-event. While everyone likes to talk down Reeves, she does understand what’s at stake here and just what it would mean to spook markets which are already this vulnerable.

Rounding this out, UK equities also look tempting. The FTSE 250 (which includes more domestically orientated stocks than the 100) has already retraced its decline amid the gilt sell-off so there is no longer a nice entry point. But with a policy outlook of deregulation, fiscal crowding in, low expectations, a resilient consumer, an outlook for falling yields, and a few reasons to expect a boost to productivity, this could be a strong year. Caveating this with the 250 is down on a five year period and with further underperformance always possible.

Obviously, the timing on this piece is a bit tough. D Trump becomes president on Monday, and policy risk is high. That said, the bullish sterling call may play out better against the euro, which might also fit in as a play on tariff risks (with the eurozone worse impacted than the UK) and any gilt play has got to be done cautiously owing to the influence the US yield curve has on the UK’s. Furthermore, as we highlighted last week, risks to the downside for US stocks are high, which could drag UK equities with them.

JB Macro is my blog, where I splurge out my brain (normally) once a week. I’m building a following for my passion, writing about economics and markets, and I would love to have you on board. Please consider pressing the subscribe button below (it’s free!!). Thank you, James.

This newsletter is for informational purposes only. It does not constitute investment advice or an offer to invest. The views expressed herein are the opinions of JB Macro exclusively. Readers should conduct their own research and consult with professional advisors before making any investment decisions.