Rewinding to last time, we did the whole woe is me thing. I have all the macro views and have been getting my econ calls spot on recently, but my execution is so piss poor that I’m hella in the red on my brokerage account this year.

I felt I needed some accountability.

But, what is really wild to me is there was clearly a period where I had this figured out. Last time I said I took my account from lows of £4250 to highs of around £5900 and if we look at my P&L over that period, we’re actually pretty solid (that is, before a recent large drawdown…). Actually, more than solid. In six months, that was my capital up 38.8% trough to peak.

In this episode, I’m going to start out with some macro views, because I feel like this is what you’re here for, then in the second part I’m gonna run through what I was doing right previously and see whether we can set some ground rules to get me back making cash money.

Current Views

We’ve got two fairly high conviction views on the go at the moment. The first one, we’re positioned for already – long gold.

Below is the reason we gave last time, but it’s worth just expanding on a bit more I think.

We like long gold with structural buying from central banks, geopolitical/policy risk, debasement/inflation risk, and we like that gold didn’t suffer as yields climbed over recent years or in H2 2024 as might have usually been expected. If yields climb again, it’s probably on debasement risk which sees gold do well again.

For me, the yields point indicates that there has been some sort of underlying structural shift in gold. Historically, gold has had an inverse relationship to yields, with gold tending to rise in line with US treasuries. This makes sense – both are safe havens and are likely good substitutes, but given gold is negative carry whereas bonds are positive carry, it makes sense for gold to lose out as yields rise/gain when they fall.

Below I’ve plotted US 10 year yields (inverted) vs gold and we can see a fairly clear relationship going on for almost the whole period, until there is a major divergence in 2022. Hm, what happened in 2022?

Well, the US and EU broke convention while sanctioning on Russia, freezing huge amounts of Russian financial assets. Western government bonds became much riskier overnight, and authorities everywhere woke up to this – we now have structural demand for physical gold.

It’s also not clear to me what higher yields would mean for gold from now – higher yields has not meant lower gold for over two years. We either get yields down (good for gold), yields sideways (good for gold?) but how do things look if yields go up?

It’s probably worth thinking about how would we get to a higher yields outlook given yields are pretty elevated right now vs recent history with inflation yet to sustainably come down to target? I think if yields are heading up from here, it will be on some sort of threat of debasement narrative, which sounds good for gold, right?

Then, we have Donald Trump in the big house. He’s signing executive orders left right and centre and risk of something going wrong somewhere feels pretty significant. He could misfire in his navigation of complex geopolitical quagmires, he could reap economic havoc with tariffs, and with stock market bubbliness really bubbling, we could see some aggressive downside moves for US equities.

The main risk scenario to our gold view is that Trump uses his more Maverick approaches (caving to Russia) to ease geopolitical tensions, but I’m unsure how sincerely markets take this. Surely it is just an opportunity for Russia to rearm and have another crack at Ukraine in a few years – this wouldn’t be the start of the reintegration of Russia into the global economy.

Our second high conviction view is that UK yields are too high with two years at 4.27% and ten years at 4.61%. With Bank Rate at 4.50%, there’s now just less than two cuts priced in for the SONIA curve come end-2026. This follows quite a hot week of economic data with inflation, wage gains, and unemployment data all coming in better than expected.

However, the BoE had already set out its stall for inflation to be up above 3.0% in 2025, and private sector pay growth of 6.1% y-o-y came in below BoE expectations of 6.2%. Further, while core inflation came in hot at 3.7%, services inflation (the measure that the BoE really cares about) came in below expectations at 5.0%.

This view here is in line with our reflexively following the Fed note from a few weeks ago, where we noted how fickle rate expectations were – it’s easy to call in hindsight but there was plenty of money to be made fading the shifts in expectations that were clearly getting extreme. It seems a bit of a winner to just not get bitched around by the economic data and assume that extreme pricing will revert.

Finally, it’s worth considering that the US curve often bosses the UK curve around, which hasn’t happened so much this week. There’s been a divergence, which could offer further support for a long gilts call.

I’m not positioned for this yet, and I want to get data released tomorrow (Fri) out of the way with GfK consumer confidence and retail sales released first. I also want to have another dive into some recent speeches from the MPC before I get involved – gilts have stung me before (see below).

I’m still developing this UK view – I might provide a longer update on it next week. But for now, I need to search my soul for just what made a six month streak in 2024 a very successful one for me and what happened for me to lose whatever I had figured out back then.

Where I Was Right And Where It Went Wrong

So where was I? In six months ending in December 2024, my capital was up 38.8% trough to peak in a winning streak (that I obviously extrapolated way too far in my head).

So, I want to try to figure out what went so right in that period, and what went wrong after. A decent part of it will be luck, but, I feel different in the process. I know things have changed. I also was pretty busy as my trading got quite shitty and I feel like I was using the markets as a bit of entertainment.

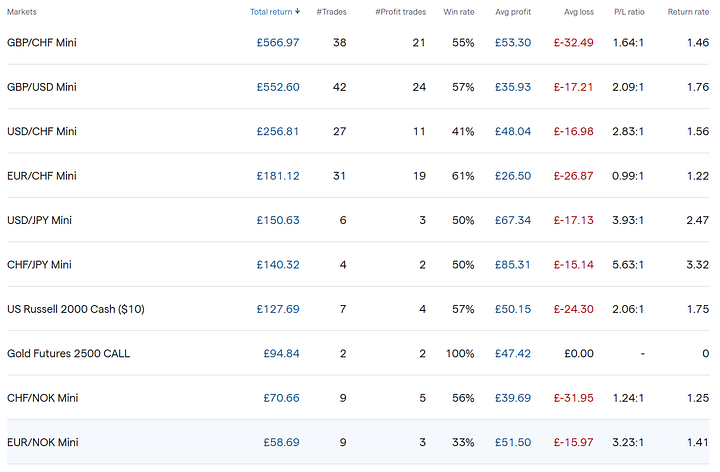

So what did we do right previously? First of all, we were truncating our losses, with our average wins much bigger than our average losses (1.57:1). We were letting our wins run with an average holding period of 2 days 14 hours and getting out of our losses quickly, holding for just short of 21 hours on average.

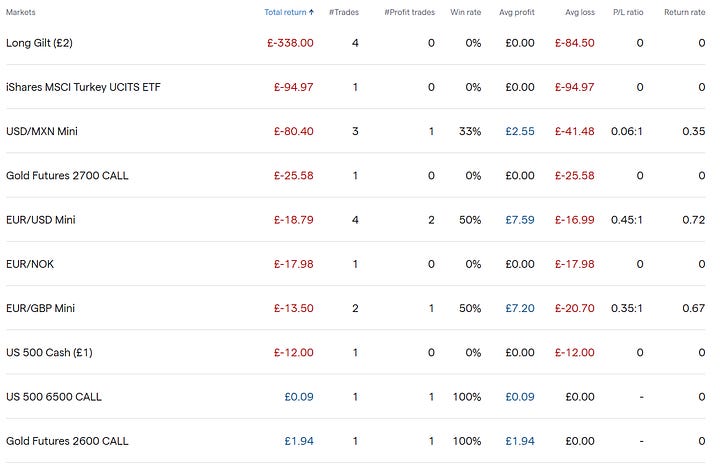

We did have one big loss, down £338 trying to fade the post Autumn budget gilt sell off. This loss was so much bigger than our other L’s, so something clearly went wrong. However, the idea was right – we would have made money on this trade, but we were in it too big and we had to tap out due to our leverage. We also didn’t cut our losses fast enough, which combined with the above gives us two rules.

Rule 1: Cut your losses and let your wins run.

Rule 2: Right-size your trades.

Also, looking through our record, across our wins, it’s obvious to me that I was really just trading things that I knew. For context, I’ve got quite a bit of experience covering the UK and Switzerland and spend quite a lot of time thinking about the euro. It makes sense for us to be making money trading these markets.

In fact, I knew this quite clearly early on – one of my earliest and most disastrous trades was short USDJPY, losing over £200 getting the timing wrong, having to tap out before the big down move I was anticipating.

In contrast, I’ve got my losses below from 1 Jan 2025 to 19 Feb. Look at this crap, what am I doing here? I don’t know anything about this nonsense how am I losing £85 trying to BTFD on Nvidia.

Another rule

Rule 3: Only trade what you know.

And another

Rule 4: Don’t instinctively fade.

And finally, I want to bring in how we’ve been trading over the last couple of days. I have some bad habits that I need to bin. I had some success in 2024 going quite high leverage into a position with a tight spot around a technical level, with the trend on side. An example, in English – USDJPY is falling, currently at 149.9, I go short at 149.9 with a stop at 150.14, and because of my tight stop I can up my leverage, it keeps falling I made dollar. It felt like easy money when it worked, but I feel that I’m constantly getting stopped out trying to up my position sizes now. You can see this in the spot gold trades below.

Rule 5: Set stops no closer than 1 day’s average trading range.

And finally, I need to stop trying to catch falling knives. That long gilt trade was just trying to catch the bottom of a move.

Rule 6: The trend is your friend, only enter positions when you’re on the right side of your moving averages.

There we have it.

Our rules

Rule 1: Cut your losses and let your wins run.

Rule 2: Right-size your trades.

Rule 3: Only trade what you know.

Rule 4: Don’t instinctively fade.

Rule 5: Set stops no closer than 1 day’s average trading range.

Rule 6: The trend is your friend, only enter positions when you’re on the right side of your moving averages.

Portfolio Update

And finally, current holdings are 3 x long cash gold and 1 mini long GBPCHF – I’m biasing short CHF at the moment and it only felt right to use the gold as a macro hedge on a risk off move.

That’s all folks.

JB Macro is my blog, where I splurge out my brain (normally) once a week. I’m building a following for my passion, writing about economics and markets, and I would love to have you on board. Please consider pressing the subscribe button below (it’s free!!). Thank you, James.

This newsletter is for informational purposes only. It does not constitute investment advice or an offer to invest. The views expressed herein are the opinions of JB Macro exclusively. Readers should conduct their own research and consult with professional advisors before making any investment decisions.